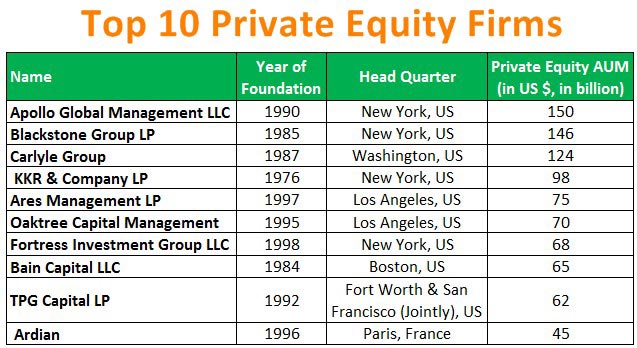

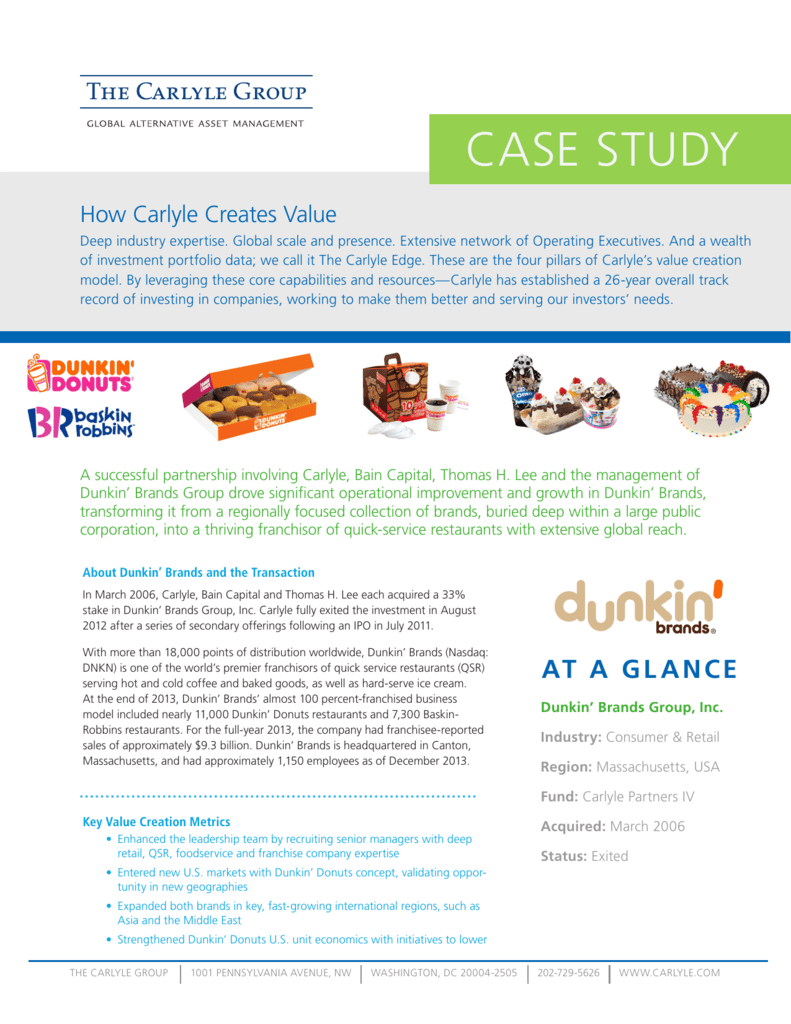

Carlyle, Centerbridge, Gallatin Point, Bain Capital Credit back Sirius Int'l merger with SPAC | PE Hub

Brookfield, Bain Capital, Carlyle, and UK-based Permira in due diligence for Blackstone-backed tech firm Mphasis | Private Equity Insights

JOIN US TODAY: Elite recruiters from The Carlyle Group, Apollo, and Bain Capital will break down how to get hired in private equity | Business Insider India